Accounting Firms Show Commitment to Marketing Amid Crisis

Accounting firms are reporting an overall commitment to marketing through the COVID-19 crisis, according to our May 2020 Growth Outlook Amid COVID-19 survey. The results were a contrast to recent recessions like the financial crisis in 2008. Differing from the mindset of tightening budgets of the 2008 recession, accounting firms today are more likely to take a wait-and-see mentality. The survey indicated that while firms are being cautious and realigning dollars, they are not necessarily cutting budgets or withholding investment from marketing as they have in the past.

The survey results showed that 38% of firms are cutting their budgets, while 49% expect not to change their marketing budgets. These figures are an indication that firms are not quick to make decisions and would rather see how the market plays out. Anecdotally, following the 2008 recession, firms reported that they realized there are certain aspects you simply cannot cut and hope to come out ahead at the end – marketing being one, talent another. Firms are learning to be more intentional rather than cutting back, which can have long-term ramifications.

How are firms adjusting their budgets?

In general, budget cuts are to be expected as the nature of doing business and markets have changed. The data shows the differences between how and where budgets are cut comes down to the size of the firm.

Across the board increases: Generally, and as expected, firms are investing heavily in software and technology to support the growing virtual environment in which they must market and communicate with clients. Email, virtual platforms, marketing automation, content creation, social media, and digital marketing are areas of increased investment. Firms that are not as far along in upgrading their technology platforms are likely feeling the push to make the investment as a result of the crisis.

Across the board decreases: Survey results showed what could be considered obvious cuts to budgets as a result of the nature of the crisis. In-person events, networking, conferences, and telemarketing efforts are all seeing decreases as a result of the virtual environment. Additionally, partner set-aside budgets and discretionary spending are also decreasing, which presents an interesting question of how and if firms will realign those dollars after the pandemic. It’s long been our observation that firms don’t see much ROI or accountability on those dollars.

The differences between large and small to mid-size firm spending become obvious in a few consistent trends.

Large* firm trends

For large firms, a decrease in advertising spend was reported four times more than other categories. This is to be expected, as advertising can be a large portion of the marketing budget and perhaps isn’t as effective during this time. Other obvious cuts included partner set-aside funds and networking expenses. Interestingly, large firms also reported cuts to content marketing, which is likely due to previously outsourcing this area (contrary to smaller firms that tended to increase in this area to keep up with bandwidth). On the flip side, training and education weren’t likely to be cut heavily at the time of the survey, as firms recognize the importance of these programs. Professional development will be an area to watch as events continue to unfold.

*Firms with $5-$30 million and greater than $30 million in revenue.

Small-to-mid-sized-firm trends

Notably, small-to-mid-sized firms reported no clear trends across the board. This result is consistent with the pattern that shows small and mid-size firm budgets are often directly reflective of a firm’s philosophy on marketing and how sophisticated they are in marketing and business development. Each firm tends to think a little differently and is in a different place on their marketing and business development journey, and smaller firms can find it challenging to level-up their grow their efforts.

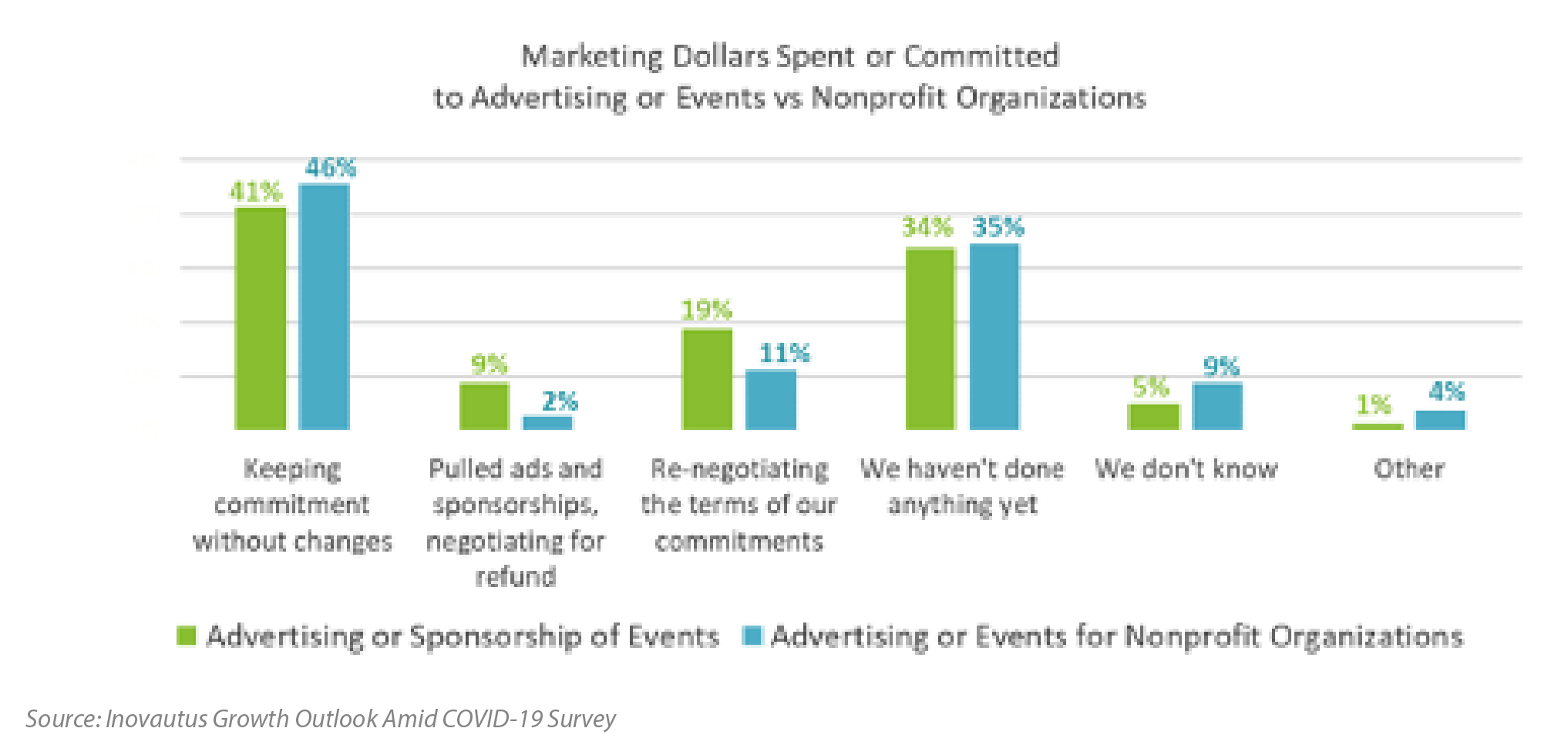

The universal commitment – Nonprofits

45% of all firms reported that they are keeping their commitments, and 34% have not yet made changes to nonprofit donation and advertising spending. This shows a clear commitment in the accounting profession to their communities. One could infer that firms are okay with waiting it out or keeping commitments, even if they have to take a loss. Larger firms were more likely to have clarity on making this decision, and most reported keeping their commitments or not yet making changes. Smaller firms, by contrast, were less likely to keep their commitments or have not yet made changes, most likely owing to the lack of time or energy to consider these commitments.

Overall, the budget trends reported in the growth survey were consistent with what one would expect from accounting firms due to the nature of the COVID-19 crisis. Firms are increasing and decreasing as expected, and the differences between large and small-to-mid-size firms are consistent with their budget philosophies and trends.

We would love to keep in touch with you when we release our fall survey! If you would like to get on our list of communications, please sign up today.