2023 Growth Survey Insights and Trends

What began as a pulse survey during the pandemic has quickly evolved into valuable knowledge and insights for accounting firms developing strategic growth plans through the Inovautus Consulting Growth Outlook Survey. This year, we uncovered a lot of great morsels that will help validate, inform, and guide a firm’s strategic planning. The results are in, and we are ready to share them with you!

In this year’s survey, we received over 100 responses from firms ranging in size from less than $8 million in revenue to firms with over $300 million in revenue. This revenue range gave us a diverse cross-section of accounting firms across the United States.

Before we dig into some of the most interesting results, let’s look at the areas of growth measured in this survey:

- Firm Financials

- Revenue Generation

- Budget

- Client Culling + Growth Challenges

- Marketing & Sales Staff

- Pricing

- Sales Efforts

- Key Operational Support

- Technology

Firm Financials

Starting with Firm Financials, we began the survey by asking for more information about their projected growth. Most firms expected higher-than-average growth, with 43% of respondents expecting growth rates higher than 11%. Only 3% of respondents expected growth lower than 5%.

It also was not unexpected that revenue from non-compliance (advisory and consulting services) was up. Most firms felt that compliance relationships are driving the need for this consulting and advisory work, in turn showing the increase in non-compliance work.

Unfortunately, along these same lines, most firms are seeing capacity issues with too much work and insufficient staff. Because of this, culling current clients seems to be happening across the board, with an average of 4.38% in 2022. What’s exciting about this information is the possibility that firms will take on more profitable engagements (advisory and consulting) to replace culled clients. This strategic replacement means that most firms are replacing low profitability clients with engagements that have higher profitability and increase the loyalty and relationship of the client.

From the perspective of our respondents, when it comes to growth, their top challenges are:

- Staffing and capacity

- Business development

- Talent acquisition and retention

- Branding

- Technology

Marketing Investments

In terms of marketing investments, we asked firms to share where they were increasing, decreasing, or keeping the same budgets for 2023. These four budget areas rose to the top, an apparent direct correlation to their top growth challenges as noted above:

- Events and networking

- Internal training

- Video and digital marketing

- Public relations

Pricing

Pricing was also a hot topic in the survey for expected changes in 2023. Last year, firms raised rates more than we have seen in our history, largely due to misalignment, staffing shortages, and retention. We asked firms to share their price increase ranges, with the majority landing between 5-9.9%, with almost one-third at >10%. There has never been a more critical time to raise rates this substantially. Usually, price increases match inflation.

In terms of pricing, one important result we found was that 57% of respondents did not have documented pricing standards or methodologies across the firm. Firms should consider this as it not only standardizes the process but ensures that each engagement is being quoted similarly across all clients.

Another interesting area of pricing was adding administrative fees to client bills to cover the costs of everything from technology to administrative tasks. Firms charging these administrative or project management fees vary from an average fee of 5% of the total bill to an average of $335 when looking at flat rate options. Regarding administration (including technology) fees, larger firms are more likely to charge a percentage of total fees, while smaller firms lean toward a flat fee.

Training & Development

When it came to sales efforts, training seemed to be an area of greater investment, but it was interesting to see that very few firms host all their sales or marketing training in-house. Fifty percent of firms fully outsource their training, while 30% use a hybrid approach with some outsourced options and in-house support, which is ideal for long-term success. It was also refreshing to see that most firms were providing staff training through partners focusing on nurturing the manager level.

Additionally, the way firms acquire new business didn’t come as a surprise that the vast majority of new business comes from referrals. What was interesting is that referrals from clients edged out referrals from a network. In recent years, firms have emphasized client service, which shows rewards in the number of satisfied clients referring new business to firms.

Key operational support showed that marketers are now spending time supporting other areas of the firm outside of their traditional marketing roles. Ninety-five percent of respondents said they are now involved in marketing promotions for recruitment purposes, and over 30% are involved in coordinating and attending recruitment events. Some are even coordinating interviews with candidates.

Technology

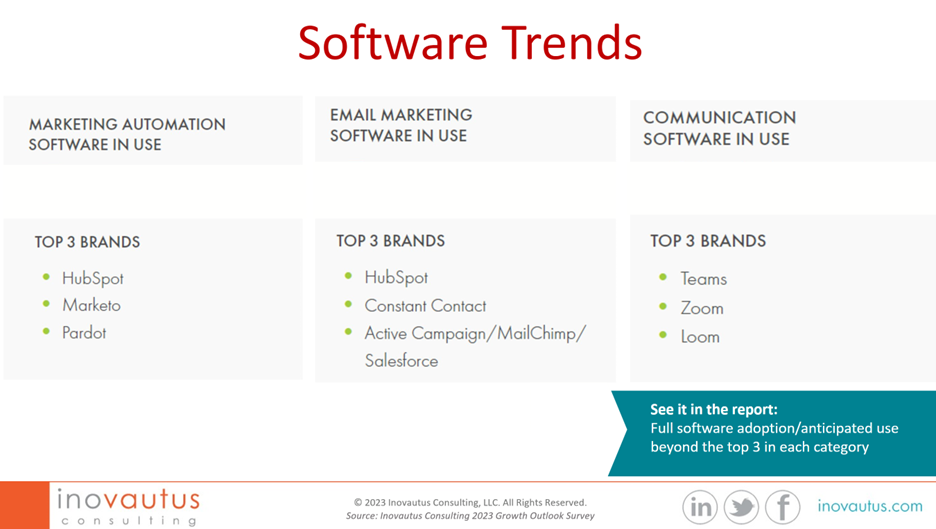

Finally, when it comes to marketing technology, the survey was able to uncover the most used software applications in the following categories:

- CRM – HubSpot

- Marketing Automation – HubSpot

- Email Marketing – HubSpot

- Communication – Teams

- Practice Management – CCH

- Social Media – HootSuite

- Design – Microsoft

Over 50% of respondents said they are not currently using any of the following software solutions:

- Marketing Automation

- Project Management

- Proposal Software

- Podcasting Software

There is a trend toward firms embracing new technology in the coming years. Most of the firms that are not using the above solutions plan on evaluating software in 2023. Marketing teams will be looking to leverage new technology and expand efficiencies by adding to their marketing tech stack.

Conclusion

In conclusion, the role of the marketing and business development teams in accounting firms continues to expand. Not only is growth on the horizon for 2023, but these teams will play a significant role in the success of growth strategies.

You can download the full 48-page report with all findings here: https://inovautusconsulting.com/thegrowthoutlookreport.

Don’t forget to reach out to AAM headquarters for a discount code available to all current members!