Growth Outlook Improving for Accounting Firms Following Pandemic

Respondents of the Inovautus and Association for Accounting Marketing Growth Outlook for CPA Firms in 2021 survey were asked to provide their outlook on net revenue and growth for 2021 following nearly 9 months of the COVID-19 pandemic.

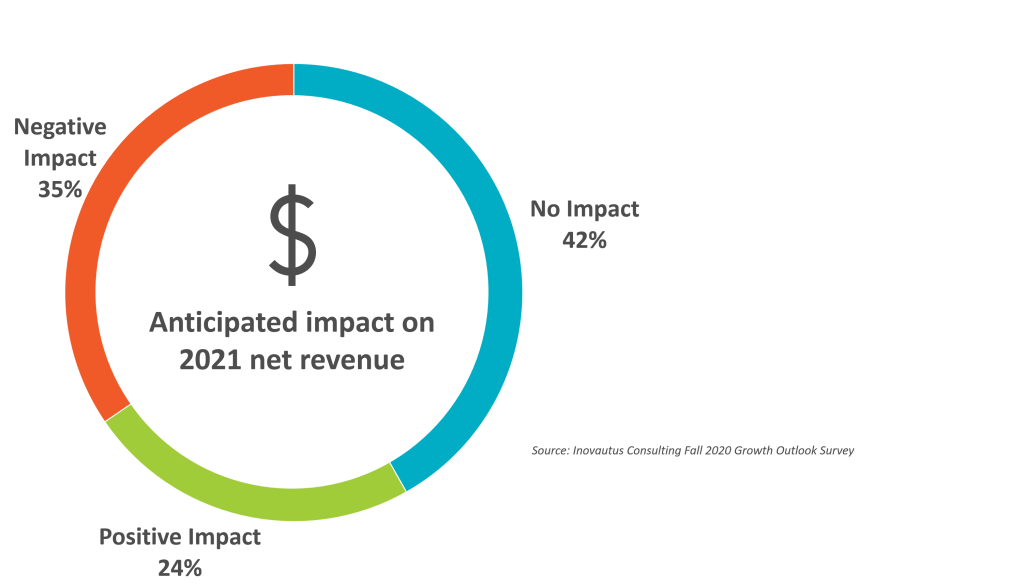

One of the most prominent questions in 2020 and going into 2021, is the impact of the pandemic on revenue for accounting firms. In this survey, respondents improved upon their revenue outlook from the spring 2020 survey with 23.64% anticipating a positive impact on revenue, 41.82% anticipating no impact on revenue, and 34.55% anticipating a negative impact on revenue. Compare that to the 73% who responded they anticipated a negative impact to revenue in the spring 2020 survey.

When breaking it down by firm size, firms over $10 million in revenue accounted for 46.15% of positive responses and 73.91% of no-impact responses, while firms under $5 million in revenue accounted for 38.89% of negative responses. This tells us that larger firms are likely better poised to respond to the issues of the pandemic or stay even.

Additionally, it can be inferred that firms less than $30 million in revenue had the most to gain during this time as their business development efforts increased significantly. We expect that firms greater than $30 million had more of an established marketing engine in place and therefore would not have seen an increase of efforts as significantly as firms of a smaller size.

The correlation between firm size, time spent on business development, and the relation to a positive outlook proves once again that growth is a mindset. Small and mid-size firms that invest in business development and marketing efforts as part of their growth strategy consistently report a positive outlook.

Potential opportunities and barriers to growth

While the struggles of 2020 were great, opportunities to assist clients arose from those challenges, and many of those opportunities will continue into 2021. Potential contributors to positive growth in 2021 shared by the respondents included:

- PPP loan program services as the program continues into 2021

- An increase in entrepreneurs spurred by the opportunities of the pandemic

- Client accounting services and cash flow analysis as firms continue to adapt and prepare for future challenges or opportunities

When we examine these findings more closely, firms with a greater input of revenue from advisory services reported feeling more optimistic about their budgeted growth. Fifty-five percent of firms with over 15% of revenue from advisory services believed they would meet budgeted growth and 50% of those believe there is an opportunity to grow at a higher rate. Counter to this, 100% of the respondents who do not offer advisory services didn’t believe there was an opportunity to grow or believed they would grow less. Advisory is a skillset and a mindset. Firms that don’t believe in and are not doing advisory report a much more negative outlook and overall response from COVID, while firms that are doing advisory were able to pivot, respond and capture opportunities.

As the pandemic continues on, it is natural that firms will face continued challenges and barriers to growth in 2021. Potential future stay-at-home orders and the general public and marketplace disruption will no doubt have an effect on marketing and business development goals for the foreseeable future. Respondents reported they were anticipating challenges with:

- Changes to business development and marketing

- Staffing capacity, retention, and efficiency

- Client retention and potential for loss in clients due to closed businesses

With this in mind, 77.5% of survey respondents personally felt like their firms were capturing all of the available opportunities during this time – this leaves nearly a third believing there are more opportunities to be had. Firms will want to consider surveying their staff and identifying additional opportunities.

Personal outlook on growth

As people are the main drivers of success at accounting firms, respondents were asked about their own personal outlook following several months in the pandemic. The response was overwhelmingly positive – including the following:

- Optimism about job security – 95%

- Confidence in continuation of roles and responsibilities – 84.5% (compared to 78% in 2020)

- Optimism for future investments in marketing and business development – 90%

- Optimism about the firm’s continuity – 97.5% (compared to 89% in 2020)

- Confidence in their firm’s preparedness in crisis management – 87.5% (compared to 79% in 2020)

- Confidence in their firm’s response so far – 87.5%

In general, shareholders were more optimistic as well as more negative, compared to marketers who had a more neutral outlook toward growth.

Conclusion

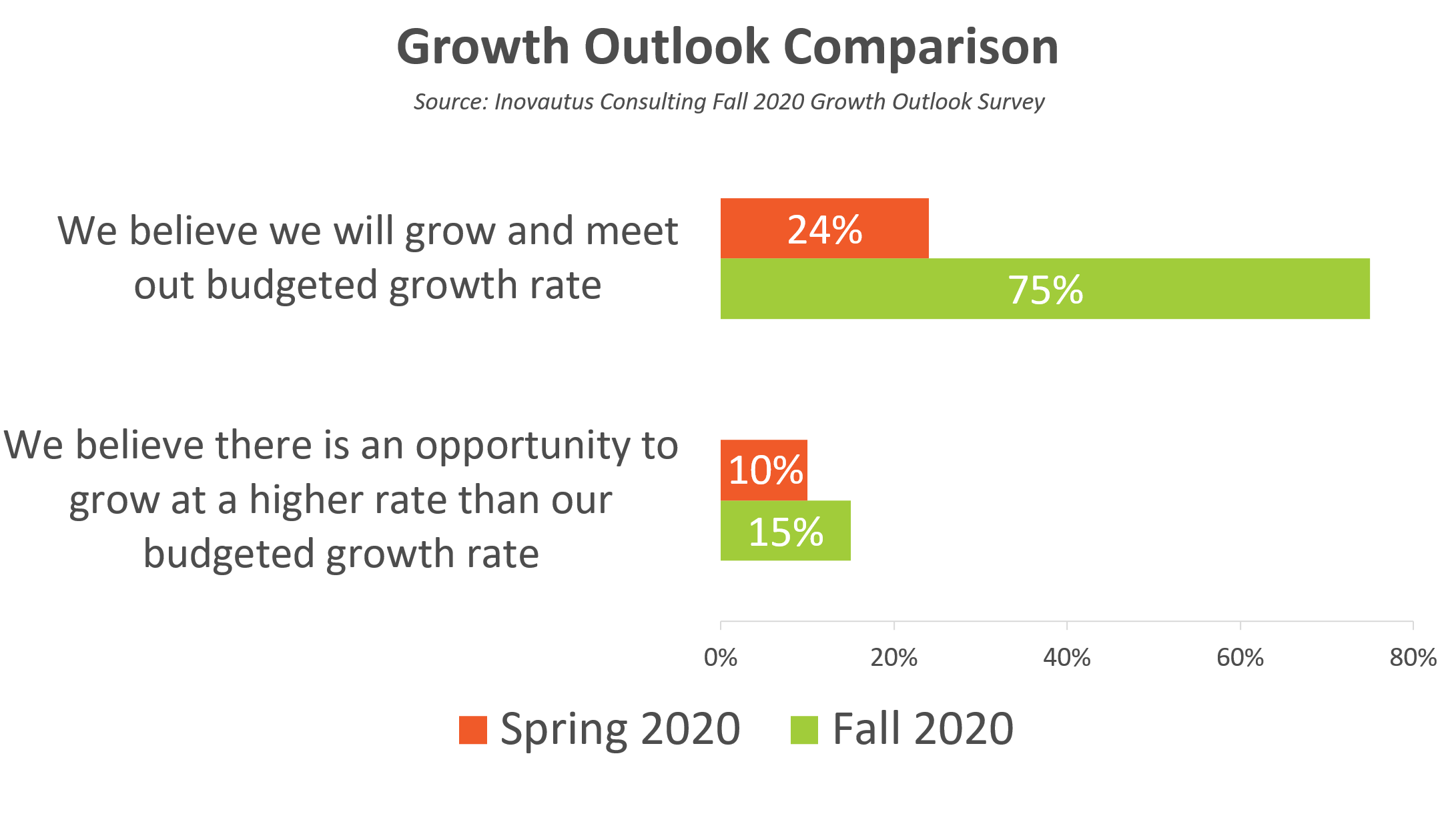

As the pandemic continues on into 2021, respondents shared their views on the length of the crisis with 90% believing it will continue through part of, and 50% believing it will continue through all, of 2021. Despite this, optimism is increasing within firms when it comes to the rate of budgeted growth. Fifteen percent believe there is an opportunity to grow at a higher rate than budgeted, and 77.5% believe they will meet their budgeted growth rate – a significant jump from just 10% and 24% respectively in the spring of 2020.

The pandemic has forced nearly every industry to evolve and rethink the services they offer to meet the turbulent and changing needs of clients. Read more in the second article in our Growth Outlook series, Accounting Firms Continue to Evolve Services to Meet Demands Amid Pandemic.